Incorporated Limited Partnerships (ILPs) in Western Australia - 2025 Guide

A partnership consists of two or more people or entities who carry on a business in common with a view to profit.

The relevant legislation governing partnerships comprises the respective partnership acts in each state and territory. In Western Australia, this is the Partnership Act 1895 and Limited Partnerships Act 2016. The rules of equity and common law also apply.

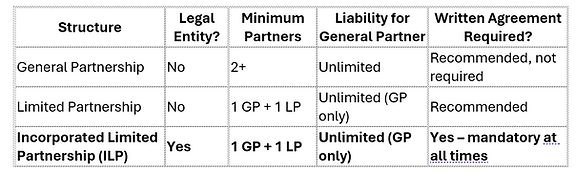

There are three main types of partnerships in Australia:

-

General partnership - where each partner has unlimited liability for the debts and obligations the partnership may incur.

-

Limited partnership - formed by and on registration and is made up of at least one general partner and at least one limited partner.

-

Incorporated limited partnership (ILP) -formed by and on registration. A separate legal entity with the powers of a body corporate that must have a written partnership agreement at all times (s 41) and at least one general partner and one limited partner (s 37).

A partnership, as a business structure, is often beneficial for smaller and less sophisticated enterprises looking to avoid the complication, expense and compliance issues which are required for a corporate structure. Professional services firms also commonly utilise a partnership structure including lawyers, accountants and architects.

General Partnerships vs Limited Partnerships vs ILPs

Key Comparisons for Western Australian Businesses

-

General partnerships remain the simplest and cheapest structure but expose every partner personally for 100 % of the debts — even those caused by another partner. They are still common for small professional firms (lawyers, accountants, architects) where the partners know and trust each other completely.

-

Limited partnerships (non-incorporated) are now rare in WA. They offer limited liability to passive partners however provide no separate legal personality and very little practical advantage over an ILP.

-

Incorporated limited partnerships (ILPs) are the clear winner for almost every modern fund or investment vehicle in Perth — especially venture capital, private equity, property syndicates, and resources projects. Why they dominate:

-

The ILP itself is a body corporate (s 35) — it can own assets, enter contracts, and sue/be sued in its own name.

-

Limited partners get true limited liability (s 49) provided they remain passive and the agreement correctly uses the s 43 safe-harbour activities.

-

A written partnership agreement is mandatory at all times (s 41) — this is uniform across every Australian jurisdiction that offers ILPs.

Quick Comparison Table (Western Australia)

Partnership Agreements

Partnerships are commonly formed by a written partnership agreement however can be formed through conduct or implied or unwritten agreements.

The partnership agreement (also known as the partnership deed and partnership articles) serves as the equivalent of a company's constitution. Key provisions will usually include at least:

-

The names of the partners and the firm name;

-

Defining the roles, responsibilities, and authority of each partner;

-

Procedures for meetings and decision-making (including voting);

-

Each partner’s agreed contributions to capital;

-

Calculation and distribution of profits and losses;

-

The admission or retirement of partners;

-

Performance evaluation, partner remuneration; and,

-

Payments following termination or departure.

All partners are obliged to adhere to the terms of this agreement as well as any other firm policies that apply to them. The partnership agreement will usually prevail over the relevant partnership act if in conflict.

These provisions are typical for general partnerships. ILP partnership agreements are significantly more detailed and must incorporate the section 43 safe-harbour activities and tax-driven provisions — see the section below.

Do ILPs in WA Require a Written Partnership Agreement? (Yes – s 41)

Yes, and not just at registration. Section 41(1) of the Limited Partnerships Act 2016 (WA) requires that a written partnership agreement must be in place at all times while the ILP is registered. This is mirrored in every Australian jurisdiction that offers ILPs, so the requirement is uniform nationally.

The agreement is the single most important document for any ILP. It must properly define the roles of general and limited partners, incorporate the s 43 safe-harbour activities (so limited partners can safely vote or advise without losing their limited liability), set out profit waterfalls, and deal with admissions, withdrawals, and dispute resolution, all while satisfying any VCLP/ESVCLP tax-concession rules if applicable.

Getting it wrong can destroy limited liability protection, trigger personal exposure for all partners, or jeopardise valuable tax concessions.

At Opportuna Legal we draft and review s 41-compliant ILP partnership agreements (and the accompanying corporate general partner constitutions) every week for Perth-and national clients. Contact us to discuss your requirements. We make the process straightforward and cost-effective.

General Partnerships v companies

A company with limited liability is increasingly preferred to a traditional general partnership. The main reason is that in a company, shareholders are not personally responsible for business debts beyond their investment, whereas in a general partnership every partner has unlimited personal liability, including for actions taken by the other partners.

Relationships in a general partnership can sour. When they do, the consequences can be financially significant because each partner remains jointly and severally liable for all partnership debts, even after the partnership has ended.

Anyone thinking about entering a general partnership should carefully consider the level of trust they have in their prospective partners, because the financial exposure is unlimited and ongoing.

ILPs and Personal Liability

In Western Australia, incorporated limited partnerships (ILPs) and limited partnerships offer some protection for limited partners, but even then at least one general partner must still accept unlimited liability.

Whilst the Act requires at least one general partner with unlimited liability (s 37), in practice many Western Australian ILPs avoid exposing individuals by appointing a company as the sole general partner.

If you are considering an ILP (with or without a corporate general partner), the partnership agreement is the critical document that makes the structure work safely and tax-effectively. One small oversight can destroy limited liability or derail valuable tax concessions.

Setting this up correctly (and drafting the accompanying partnership agreement and constitution) requires careful consideration of the issues arising between corporate and partnership law. Opportuna Legal structures these arrangements regularly.

If you are unsure whether a general partnership, limited partnership, company, or another structure is best for your situation, contact Opportuna Legal for a more detailed discussion about the right business structure for you.

This article contains general information only and is not legal advice. Business structure decisions should always be made with advice specific to your circumstances